All Categories

Featured

Table of Contents

The inquirer stands for a client who was a plaintiff in an accident matter that the inquirer cleared up on part of this complainant. The accuseds insurance firm accepted pay the plaintiff $500,000 in an organized settlement that needs it to purchase an annuity on which the plaintiff will certainly be noted as the payee.

The life insurance firm issuing the annuity is a certified life insurance policy firm in New York State. N.Y. Ins.

N.Y. Ins.

N.Y. Ins. The Department has reasoned that an annuitant is the possessor of the basic right provided under an annuity contract and specified that ". NY General Advise Point Of View 5-1-96; NY General Counsel Opinion 6-2-95.

What Is Annuity Rates

Although the owner of the annuity is a Massachusetts firm, the desired beneficiary and payee is a homeowner of New york city State. Considering that the above mentioned purpose of Article 77, which is to be liberally interpreted, is to protect payees of annuity contracts, the payee would certainly be shielded by The Life insurance policy Business Guaranty Company of New York.

* An immediate annuity will not have an accumulation stage. Variable annuities released by Safety Life Insurance Policy Business (PLICO) Nashville, TN, in all states other than New York and in New York by Protective Life & Annuity Insurance Coverage Company (PLAIC), Birmingham, AL.

Aig Fixed Rate Annuity

Financiers must meticulously think about the financial investment goals, risks, costs and expenditures of a variable annuity and the underlying financial investment choices prior to spending. An indexed annuity is not an investment in an index, is not a security or supply market financial investment and does not participate in any type of stock or equity investments.

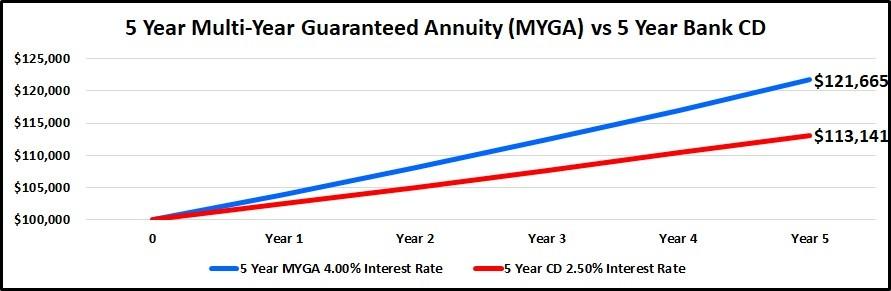

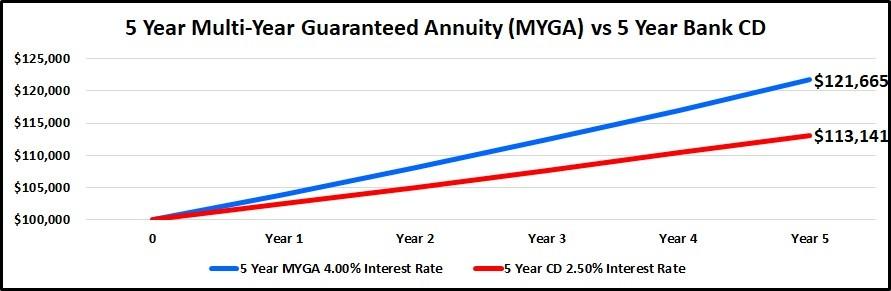

The term can be 3 years, 5 years, 10 years or any type of number of years in between. A MYGA works by connecting up a lump sum of cash to permit it to accumulate passion.

Annuity Paid

If you pick to renew the contract, the rate of interest price may differ from the one you had originally concurred to. Because passion rates are established by insurance policy companies that sell annuities, it's crucial to do your research study prior to authorizing a contract.

They can postpone their tax obligations while still used and not in demand of extra taxable revenue. Given the present high rates of interest, MYGA has become a considerable element of retired life economic preparation - fixed annuity income calculator. With the chance of passion rate decreases, the fixed-rate nature of MYGA for a set number of years is highly interesting my customers

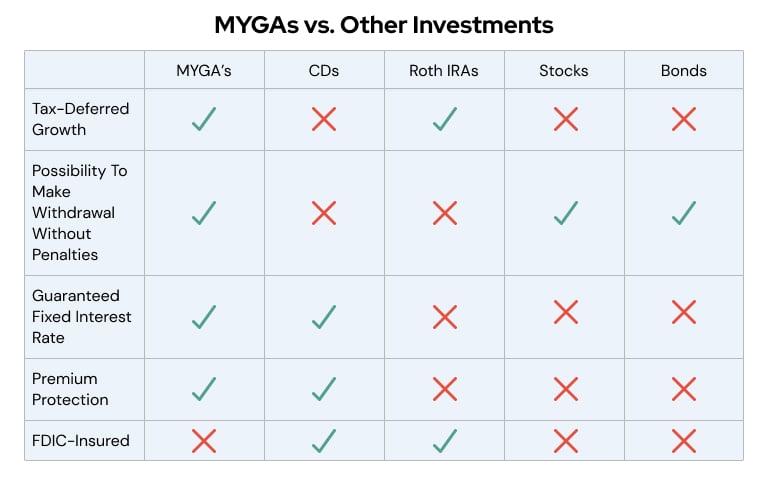

MYGA rates are typically greater than CD prices, and they are tax deferred which better boosts their return. An agreement with more limiting withdrawal arrangements may have higher rates.

In my opinion, Claims Paying Ability of the service provider is where you base it. You can glimpse at the state guaranty fund if you want to, yet remember, the annuity mafia is watching.

They recognize that when they put their money in an annuity of any type of kind, the company is going to back up the insurance claim, and the sector is managing that. Are annuities ensured? Yeah, they are. In my viewpoint, they're safe, and you ought to enter into them looking at each carrier with self-confidence.

If I put a recommendation in front of you, I'm additionally placing my license on the line. I'm really positive when I placed something in front of you when we chat on the phone. That does not indicate you have to take it.

Immediate Payout Annuity

We have the Claims Paying Ability of the provider, the state warranty fund, and my friends, that are unidentified, that are circling with the annuity mafia. That's a valid response of a person that's been doing it for a really, extremely long time, and that is that someone? Stan The Annuity Guy.

Individuals typically purchase annuities to have a retired life income or to build financial savings for an additional objective. You can acquire an annuity from an accredited life insurance policy representative, insurance provider, economic coordinator, or broker. You should talk with an economic consultant concerning your demands and objectives before you buy an annuity.

How Does An Immediate Annuity Work

The difference between the 2 is when annuity repayments begin. You do not have to pay taxes on your revenues, or contributions if your annuity is an individual retired life account (INDIVIDUAL RETIREMENT ACCOUNT), till you take out the earnings.

Deferred and immediate annuities offer numerous choices you can choose from. The choices give different degrees of possible threat and return: are guaranteed to make a minimum rate of interest price.

Variable annuities are higher danger since there's an opportunity you might shed some or all of your money. Set annuities aren't as high-risk as variable annuities because the financial investment threat is with the insurance policy business, not you.

Contingent Deferred Annuity

If performance is reduced, the insurer bears the loss. Fixed annuities assure a minimal interest price, generally in between 1% and 3%. The company might pay a higher rates of interest than the ensured rates of interest. The insurance business determines the interest rates, which can alter month-to-month, quarterly, semiannually, or yearly.

Index-linked annuities show gains or losses based on returns in indexes. Index-linked annuities are a lot more complicated than taken care of delayed annuities. It's crucial that you comprehend the functions of the annuity you're taking into consideration and what they imply. The 2 contractual attributes that impact the amount of rate of interest credited to an index-linked annuity one of the most are the indexing method and the participation rate.

Each relies upon the index term, which is when the business determines the interest and credit histories it to your annuity. The identifies exactly how much of the increase in the index will be utilized to calculate the index-linked interest. Other important features of indexed annuities consist of: Some annuities cover the index-linked rates of interest.

The flooring is the minimal index-linked passion rate you will make. Not all annuities have a floor. All taken care of annuities have a minimal guaranteed worth. Some firms use the average of an index's worth as opposed to the value of the index on a specified day. The index averaging might occur at any time throughout the regard to the annuity.

Other annuities pay compound rate of interest during a term. Compound interest is interest made on the cash you conserved and the interest you make.

Fixed Annuity Income Calculator

If you take out all your money prior to the end of the term, some annuities won't attribute the index-linked interest. Some annuities could credit only part of the interest.

This is since you bear the investment danger as opposed to the insurer. Your representative or financial consultant can assist you make a decision whether a variable annuity is right for you. The Securities and Exchange Commission categorizes variable annuities as safety and securities due to the fact that the efficiency is stemmed from stocks, bonds, and other financial investments.

Lifetime Income Rider Annuity

Discover more: Retirement in advance? Believe regarding your insurance coverage. (when can you cash out an annuity) An annuity agreement has 2 phases: a buildup phase and a payment phase. Your annuity earns passion throughout the accumulation stage. You have a number of choices on exactly how you contribute to an annuity, depending on the annuity you acquire: enable you to choose the time and amount of the repayment.

enable you to make the exact same payment at the exact same interval, either monthly, quarterly, or each year. The Internal Income Solution (INTERNAL REVENUE SERVICE) controls the taxation of annuities. The internal revenue service allows you to delay the tax on profits till you withdraw them. If you withdraw your earnings before age 59, you will most likely need to pay a 10% very early withdrawal fine in enhancement to the taxes you owe on the interest made.

After the buildup phase ends, an annuity enters its payout stage. This is often called the annuitization stage. There are several options for getting repayments from your annuity: Your firm pays you a fixed amount for the time specified in the contract. The business pays to you for as lengthy as you live, however there are none settlements to your successors after you pass away.

Numerous annuities charge a penalty if you take out cash before the payout stage. This charge, called an abandonment cost, is usually greatest in the very early years of the annuity. The fee is often a percent of the taken out money, and usually starts at around 10% and drops yearly till the abandonment period is over.

Table of Contents

Latest Posts

Understanding Financial Strategies A Closer Look at How Retirement Planning Works What Is Deferred Annuity Vs Variable Annuity? Pros and Cons of Various Financial Options Why Choosing the Right Financ

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial S

Highlighting Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Fixed Annuity Vs Variable Annuity What Is the Best Retirement Option? Features of Smart Investment Choices Why Choosin

More

Latest Posts